WHAT is ESTATE PLANNING?

Estate planning is the process by which an individual plans to pass on his or her wealth, including investments and life insurance, upon death to a chosen person(s), with the goal of:

- Preserving and/or enhancing the value of the estate to the extent possible

- Ensuring delivery of the intended amounts to the appropriate persons; and

- Minimizing taxes, where possible

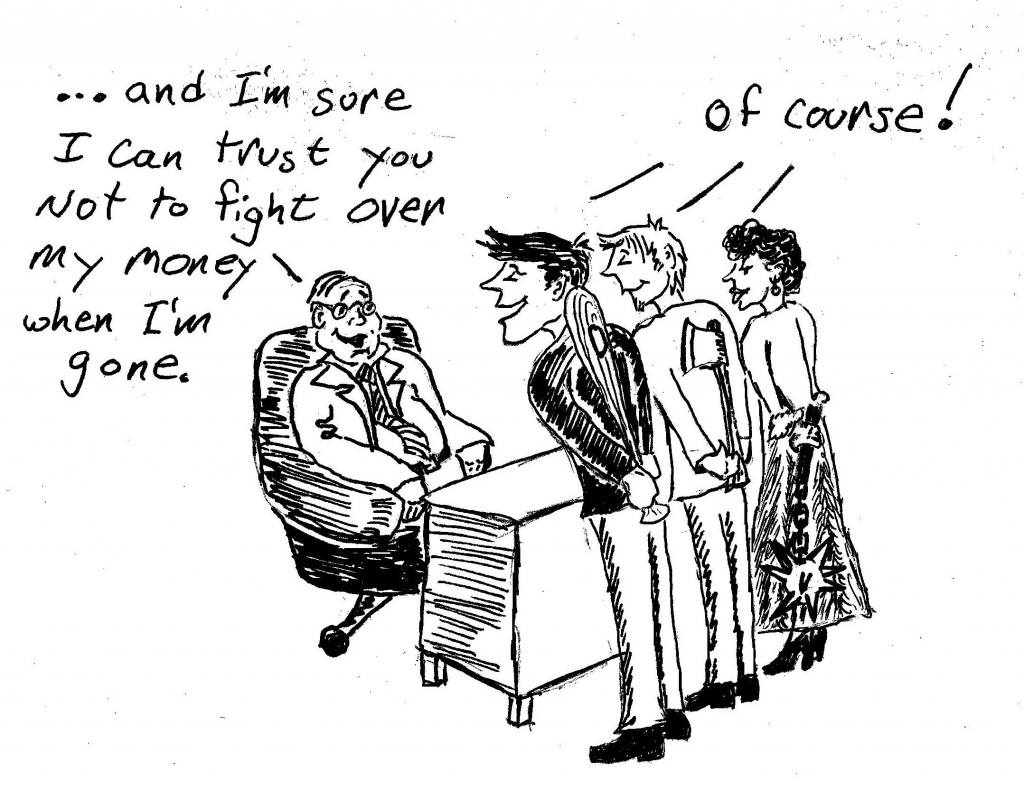

Planning your estate matters is first and foremost about having a will. But it can also be much more. A well-thought-out estate plan ensures that your family is cared for should something happen to you, and that your money goes where you want it to. It's an important pillar of managing your wealth.

If you die without a will, your assets are distributed according to provincial legislation. This may result in a loss of control. It may also necessitate additional time and legal fees to settle your estate issues. Anyone getting married, separated, divorced, remarried or having children should revisit their current will. Review your family's needs and ability to maintain their lifestyle if something happens to you. Check the beneficiary designations for accounts such as your RRSP, RRIF, RESP, DPSP (deferred profit-sharing plan), pension plans, and life insurance policies.

We will recommend solutions that help maximize your estate’s value, while helping to ensure your beneficiaries will receive everything you’ve planned for them.